Вавада Казино - Официальный сайт Vavada

Online-казино основано в 2017 году. В первые годы деятельности оно не пользовалось большой популярностью. Но все изменилось благодаря продуманным бонусным программам и преимуществам, которые внедрил официальный сайт Vavada, чтобы продемонстрировать высокий уровень надежности. В последнее время бренд фигурирует в топовых списках и находится на слуху в гемблинг-индустрии многих стран СНГ, Азии, Европы и Америки. Начинающие гемблеры заходят на игровую платформу и получают практический опыт в демо-версиях слотов и настолок.

Мастера гемблинга регистрируются и подключаются к многочисленным играм и турнирам. Они получают приветственные бонусы, за считанные часы отыгрывают прибыль и мгновенно выводят кэш на карту или расчетный счет. Дополнительно зарегистрированные юзеры пользуются такими плюсами:

- Разными точками доступа в Vavada casino. Работает официальный сайт, его зеркало и отдельные приложения для мобильных устройств и компьютера. Они одинаково удобны, многофункциональны и зашифрованы SSL сертификатами.

- Богатой игротекой. В ассортименте более 5000 игровых аппаратов. Среди них классика категорий слоты и столы, современные видеослоты и быстрые краш-игры, лайвы и турнирные состязания за крупный приз.

- Функциональным личным кабинетом. В пользовательском пространстве выполняются настройки профиля и депозита, выполняются все платежные операции, находится информация о бонусах.

- Удобным депозитным счетом. Игрок открывает кошелек в одной из 22 валют. К тому же доступны популярные криптовалюты.

- Круглосуточной поддержкой. Если возник вопрос, гемблеры обращаются в чат саппорта, который работает на всех ресурсах онлайн casino Вавада. Диалоговое окно всплывает при нажатии кнопки «Помощь». Резервный канал связи – электронная почта и модераторы социальных сетей проекта: Телеграм-канал, Instagram и VK.

| 🥮 Бренд | Vavada |

| 🥮 Официальный сайт | |

| 🥮 Рабочее зеркало |

Актуальное зеркало - перейти на зеркало |

| 🥮 Платформы | iOS, Android, Windows |

| 🥮 Количество игр | 3600+ |

| 🥮 Языки | RU, EN |

| 🥮 Саппорт | Live-чат, контактный телефон, skype, email |

| 🥮 Мин. депозит | 50 RUB |

| 🥮 Мин. вывод | 1000 RUB |

Сейчас портал расширяет гео-охват, предлагая ценителям азарта из разных стран мира новые возможности сервиса. Интерфейс приобрел 18 языковых версий, кошелек более 17 способов оплаты, консультанты саппорта консультируют на английском и русском языках.

Зеркало официального сайта Vavada

Казино работает по международной лицензии компании-регулятора Кюрасао. Она становится гарантом надежности и честности заведения. Но не во всех странах разрешение нидерландской комиссии является основанием для предоставления услуг. Их законодательство требует локального лицензирования. В таких случаях веб-ресурсы бренда блокируются, что не останавливает легальное заведение работать в штатном режиме, только с помощью зеркал. Зеркальные порталы – это копии основного сайта, которые идентичны с ним по функционалу, оформлению и контентному наполнению. Дубликаты подключаются к тому же серверу, что и прототип, поэтому имеют доступ к базе данных. Когда действующий клиент авторизуется в системе зеркальной платформы, он восстанавливает всю информацию профиля. Депозиты и достижения остаются в неизменном состоянии. Если регистрируется новичок, он может использовать данные аутентификации на всех точках доступа в онлайн-казино.

Актуальное на сейчас рабочее зеркало Вавада находится на отличном от прототипа доменном адресе. Это единственное отличие, которое выливается в необходимость узнавать новый домен. Чтобы найти ссылку на зеркало, новым клиентам и завсегдатаям рекомендованы такие способы:

- Войти и подписаться на соцсети. Подписчики узнают из публикаций не только новости, но и обновленные URL зеркал.

- Обратиться к администраторам соц-сообществ.

- Написать в техподдержку на e-mail.

- Сразу же после регистрации оформить подписку на новостную рассылку и получать линки на свою почту.

Использовать зеркала из неофициальных источников не рекомендуется. Если скопировали URL-адрес на сайте-обзорнике или тематическом форуме, проверьте его подлинность в техподдержке или соцсетях.

Регистрация на Вавада

Создать аккаунт могут те, кто ранее не регистрировался и достиг возраста 18 лет. Процедура не займет много времени, так как состоит из нескольких простых действий. К ним относятся:

- Открытие регистрационного окна. Для этого щелкните по кнопке красного цвета. Она находится в шапке страницы веб-платформы.

- Заполнение формы. Она состоит из строчки для логина (введите свою электронную почту) и пароля.

- Выбор валютное единицы депозита.

- Ознакомление с правилами и положениями конфиденциальности.

Авторизованный вход на Vavada com выполняется в момент нажатия на «Регистрация» в нижней части регистрационного окна. После необходимо перейти в профиль персонального офиса и подтвердить созданный аккаунт. Чтобы начать процесс подтверждения, нажмите вверху экрана на надпись «Получить линк на имейл». Откройте почту, которую указывали при регистрации и перейдите по ссылке. Затем вернитесь в профильную вкладку и заполните личную анкету. По желанию, спуститесь вниз странички и пройдите верификацию. Вставьте в окошко фото паспорта и отправьте файл на обработку. Если желаете пропустить этот пункт идентификации, можете сделать это. Администрация не настаивает на верификации до тех пор, пока пользователь соблюдает правила казино.

Бонусы Вавада на сегодня

Помимо одноразовых акций и поощрений за персональные достижения, администрация выплачивает четыре вида постоянных бонусных наград. В этот пакет входят два приветственных подарка, кэшбэк и промокоды. Также игроки награждаются привилегиями по программе лояльности. По условиям системы вознаграждений все бонусные средства отыгрываются с указанным вейджером. Чтобы отыграть прибыль, гемблеры делают ставки за реальные деньги на сумму, которая соответствует выигрышу умноженному на коэффициент прокрутки.

Приветственный бонус за регистрацию

В презенте для новоприбывших 100 бездепозитных фриспинов. Они активируются автоматически и готовы к применению с первой секунды после авторизации игрока. Welcome вращения от Вавада предназначены для слота Great Pigsby Magaways и могут быть использованы только в этом симуляторе. Отыгрывать сорванный куш разрешается в любой виртуальной игре из каталога с вейджером х20. Срок действия бездепа ограничен двумя неделями. За это время нужно потратить, прокрутить и вывести кэш, иначе он аннулируется.

Двойной множитель на депозитный счет

Впервые проведенная оплата на депозит поощряется бустером в размере 100%. Это значит, что любой платеж до 1000$ увеличится вдвое. Дополнительные деньги можно потратить в симуляторах на усмотрение гемблера. Отыграть доход с вейджером х35. Продолжительность действия вознаграждения – 14 дней.

Промокоды Вавада

Спрятанные под кодовые комбинации бесплатные ставки и денежные прибавки выплачиваются тем, кто проявляет активность на портале, соцсетях и каналах партнеров проекта. Промокод от casino Vavada выплачивается, если игрок часто играет на реальные деньги, участвует в промоакциях социальных групп, комментирует посты и ставит под ними лайки, подписывается на все доп-ресурсы заведения и делает другие аналогичные действия. Подарочные коды активируются в бонусной вкладке личного кабинета.

Кэшбек

Компенсация расходов за месяц гемблинга выплачивается только тем, кто проиграл за тот же период больше, чем выиграл. Выплата в размере 10% от общих затрат приходит на бонусный баланс и действует 14 дней с момента зачисления. Она доступна для ставок в любых слот-машинах и столах. Прибыль отыгрывается с вейджером х5.

Программа лояльности

Более выгодные условия обслуживания присваиваются тем гемблерам, которые активно играют на денежные средства. Чем больше сумма ставок, тем прибыльнее гемблинг. Условия системы поощрений смотрите в таблице:

|

Депозит ($) |

Привилегии |

Статусы Loyalty Programme |

|

0 |

Стандартный сервис: открыты общедоступные розыгрыши, ежедневный лимит на вывод выигрышей до 1000$. |

New |

|

15 |

Player |

|

|

250 |

Активируется допуск к кэш-турнирам с бесплатными ставками и выигрышами до 7500$. Границы кэшаута расширяются до 1500$ в день. |

Bronza |

|

4000 |

Доступны фриспин-турниры с призовыми фондами до 25000$. Суточная граница вывода прибыли – 2000$. |

Silver |

|

8000 |

Все состязания с бесплатными бетами открыты для участия, лимиты расширены до 5000$ в сутки, поддержку клиентов осуществляет личный менеджер. |

Gold |

|

50000 |

Все перечисленные привилегии дополняются дополнительными бонусами и промокодами от Вавада. |

Platinum |

Приобретенный ранг требует ежемесячного подтверждения. В течение 30 дней гемблер должен потратить сумму, соответствующую необходимому статусу.

Мобильное приложение

Многие игроки не прочь запускать любимые геймы в своем телефоне. Для этого казино предлагает специальное программное обеспечение, которое подходит для установки на смартфоны с iOS и Android. Оно обеспечивает пользователям тоже удобство, функциональные возможности и навигацию интерфейса, что и десктоп. Позволяет играть во все симуляторы, лайв-настолки, турнирные автоматы и столы. Объем APK-файла – 35 Мб, утилита надежно защищена от кибератак и вирусов, поэтому никак не повредит работе портативного устройства.

Чтобы скачать Vavada на телефон, обратитесь с заявкой к операторам саппорта. Они вышлют вам ссылку для установки приложения.

Игровые автоматы

В игровом лобби гемблеров ждут классические, культовые и современные барабаны, хитовые краш-аппараты и столы с виртуальным и настоящим дилером. Чтобы выбрать для себя подходящий эмулятор, нужно использовать фильтры по провайдеру, популярности на портале и новизне релиза. Более опытные поклонники азарта давно определили приоритетных для себя поставщиков софта, начинающим геймерам стоит стартовать с подборки «Hit». В ней представлены самые дающие (RTP от 95%), увлекательные и прибыльные автоматы. Их максимальный множитель достигает х100000, у некоторых слотов есть прогрессивный джекпот. Удачная ставка в таких барабанах может принести до 214000$ и выше, поскольку мега-куш постоянно увеличивается.

В числе лучших игр на Вавада находятся такие симуляторы:

|

Название |

Разработчик |

Вид аппарата |

RTP (%) |

Наибольший выигрыш |

|

Lucky Streak 3 |

Endorphina |

Слот классика с катушками 3х3 |

96 |

5000 монет |

|

Gates of Olympus |

Pragmatic Play |

Слот-машина с игровым полем 6х5 |

95,51 |

х5000 |

|

Dogs Street |

Turbo Games |

Стол, в котором нужно накормить много собак |

95% |

Больше собачек, крупнее куш. |

|

Turbo Roulette Live |

Evolution |

Рулетка с секторами, разделенными по цветам и цифрам |

97,3% |

х1000 |

Многие виды настольных игр проводятся в live-режиме под руководством профессионального крупье. Они транслируются в реальном времени, 24/7, что дает возможность подключится к прямому эфиру в любую минуту дня и ночи. Для ставок необходима настоящая валюта, бонусы дилеры не принимают.

Те, кто предпочитают напряженное соперничество с солидными призовыми, заходят в турниры. В их разделе представлены пять форматов состязаний за призовой фонд. Игроки выбирают сражения со ставками на деньги либо поднимают статус и участвуют в бесплатных соревнованиях. Профит от участия в турнире Вавада – от 100$ до 12000$, не считая сорванных заносов.

Партнерская программа

Сотрудничество с веб-специалистами – способ продвижения онлайн-казино. Управляющая компания принимает в партнеры всех желающих и предлагает:

- Оплату до 60% по RevShare (за каждого реферала) и до 300$ по CPA (за выполненное рефералом действие).

- Индивидуальные параметры договора. Подбираются в зависимости от имеющихся у партнера ресурсов.

- Помощь в оптимизации каналов трафика сотрудника партнерки и круглосуточная связь с аффилейтом.

Чтобы начать переговоры о партнерстве, напишите в поддержку Вавада. Консультанты предоставят контакты менеджера, который занимается вопросами партнерки.

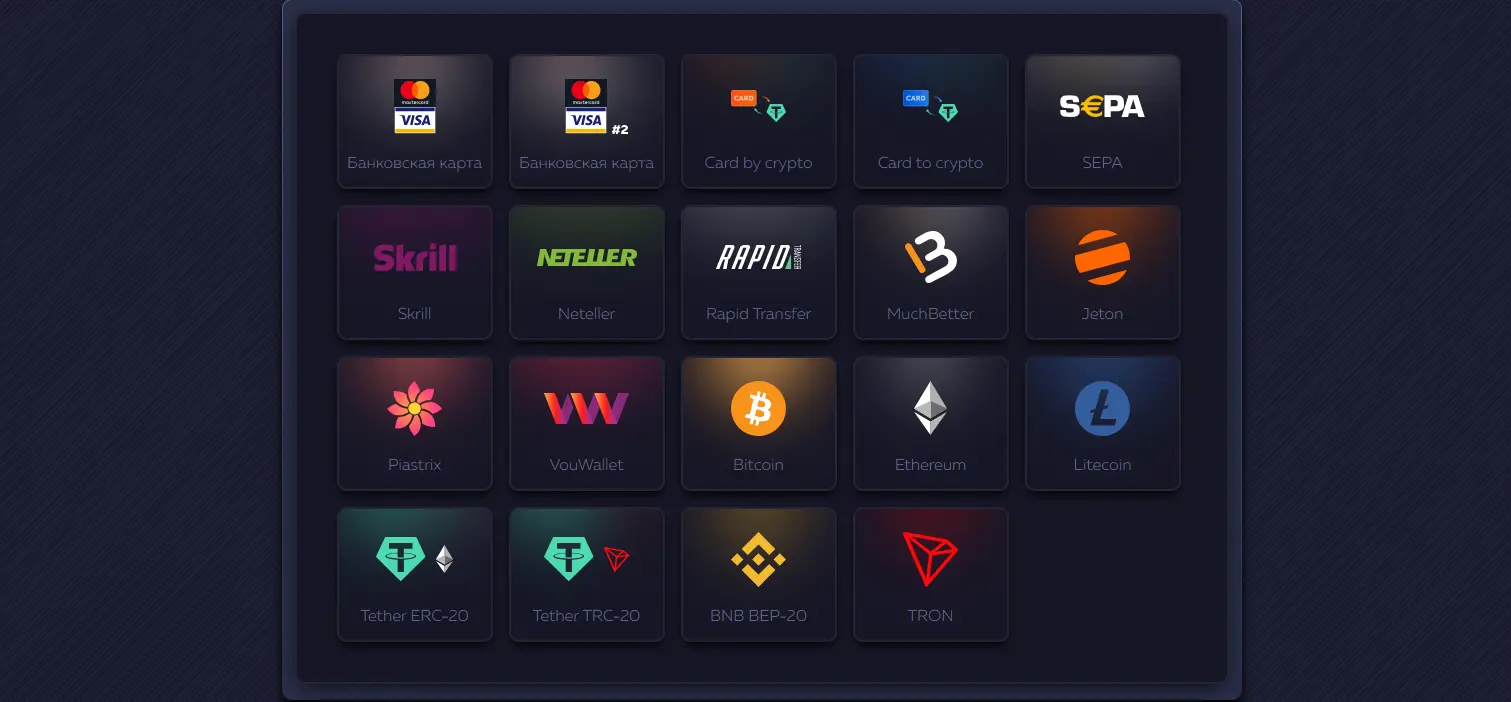

Способы пополнения и вывода средств

Оплаты на депозитный счет и вывод выигранных средств осуществляются с помощью надежных и удобных сервисов. Среди них присутствуют карты банковских систем (Виза и Мастеркард), Е-кошельки (Сепа, Leton, Piastrix, MuchBette и другие) и криптопровайдеры (TRON, Биткоин, BNB BEP-20, Ethereum и похожие биржи). Чтобы провести транзакцию можно выбирать любого оператора, но выполнять входные и выходные платежи одним сервисом.

Минимальная сумма пополнения – от 1$, максимальной нет. Минимум для оформления кэшаута – 20$. Со стороны казино Vavada комиссии не взимаются, но комиссионный взнос взимают платежные системы. Их размер варьируется от 0,1% до 5%. Учитывайте это при выборе способа проведения финансовой операции.